Ecosystem: A community of organisms together with their physical environment, viewed as a system of interacting and interdependent relationships and including such processes as the flow of energy through trophic levels and the cycling of chemical elements and compounds through living and nonliving components of the system. Source: American Heritage Science Dictionary

Borrowing from biology 101, most organizations today understand the essential role a network of business relationships – suppliers, distributors, customers, competitors – plays in bringing products and services to market. Put simply. it’s the idea that each partner in the “ecosystem” affects and is affected by the others, creating an evolving set of relationships in which participants must be willing to bend and adapt in order to thrive.

In his book, The Wide Lens: A New Strategy for Innovation, Ron Adner, a professor of strategy at the Tuck Business School at Dartmouth, brings this point home by citing many commercial flops (e.g. Sony’s 2007 e-Book Reader; Hollywood’s attempt to bring digital cinema to American theaters in the 1990s) due to a failure to see the whole ecosystem. His point:

“Greatness on your part is not enough. You are no longer an autonomous innovator. You are now an actor within a broader innovation ecosystem. Success in a connected world requires that you manage your dependence. But before you can manage your dependence, you need to see it and understand it. Even the greatest companies can be blindsided by this shift.”

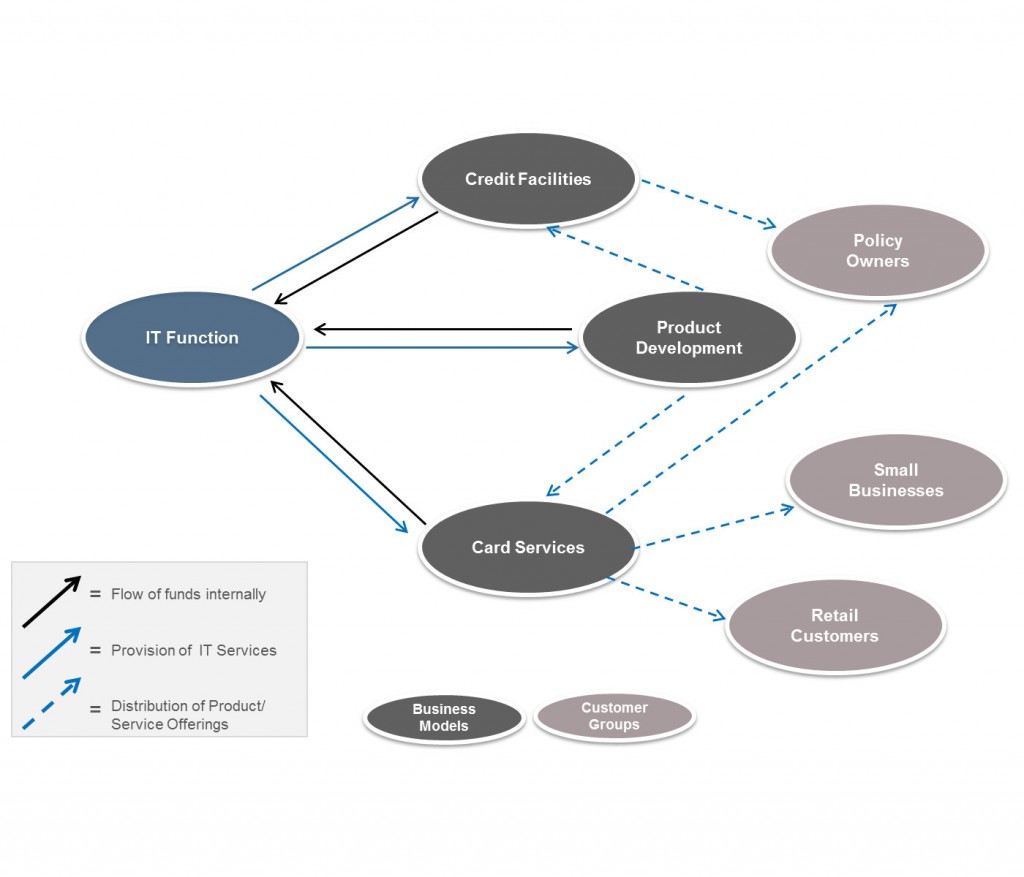

Taking stock of the ecosystem required by new innovations is a core tenet of Business Model Innovation (BMI). We advise clients that mapping stakeholder relationships (see illustrative graphic below for an IT department in a financial services company) surrounding the innovation is instrumental to illuminating the risks and dependencies that could catapult or kill a great idea on its way to success.

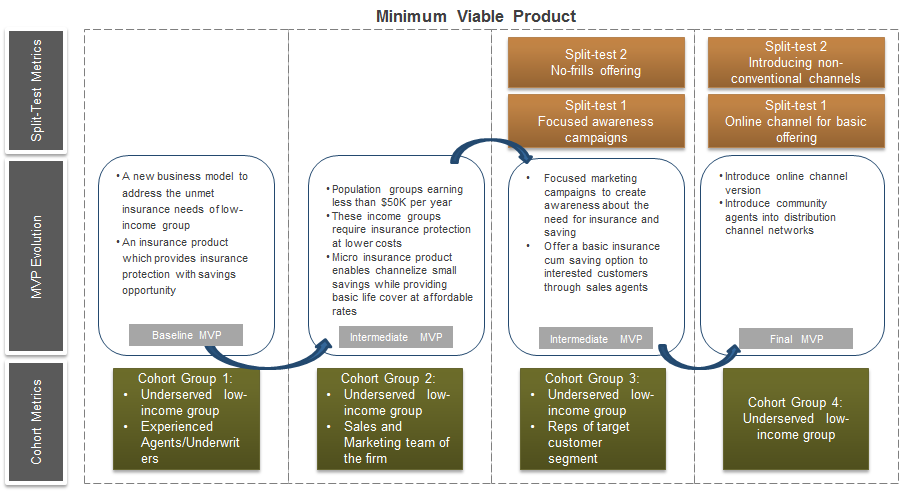

Identifying the potential land mines in the ecosystem is only a starting point. To vet the implications of the relationships on the innovation’s business model, organizations must run a series of experiments with stakeholders, focusing on each point in the ecosystem where uncertainty is greatest. Through testing, organizations will gain the requisite insights for de-risking the partner selection process and the terms and conditions governing their roles. As the business model evolves, so must the ecosystem to ensure that all interests between stakeholders and their end consumers remain aligned.